Identifying ESG Performance Risk

Incorporating sustainability/ESG into asset management may be the most far-reaching change in the investment industry since Modern Portfolio Theory.

The esteemed Business Roundtable has underscored the key role of sustainability by redefining a corporation’s purpose to include serving all stakeholders because “it is the only way to be successful over the long term.” Clearly, ESG factors affect every business, thereby affecting every investor and investment strategy. But what does that mean, in practical terms?

It’s about making better decisions.

ESG data offerings are expanding, but until now, there has been no clear way to use that data to improve investment decisions. In collaboration with our partner, Confluence Analytics, we show how to make better decisions that reduce risk, whatever your investment strategy.

In any given universe, benchmark or fund, every stock is either in the top or bottom half, based on a chosen ESG score or ranking. But that’s not enough information.

ESG rankings alone are not designed to be performance-related. We combine rankings with a proprietary ESG-based alpha signal (forward-looking excess return, adjusted for market and sector) that is easy to interpret – either positive or negative – for every stock. The alpha signal, stand-alone or combined with any other metric, can steer investors away from risky positions that hurt performance.

Transforming ESG Data into Actionable Insights

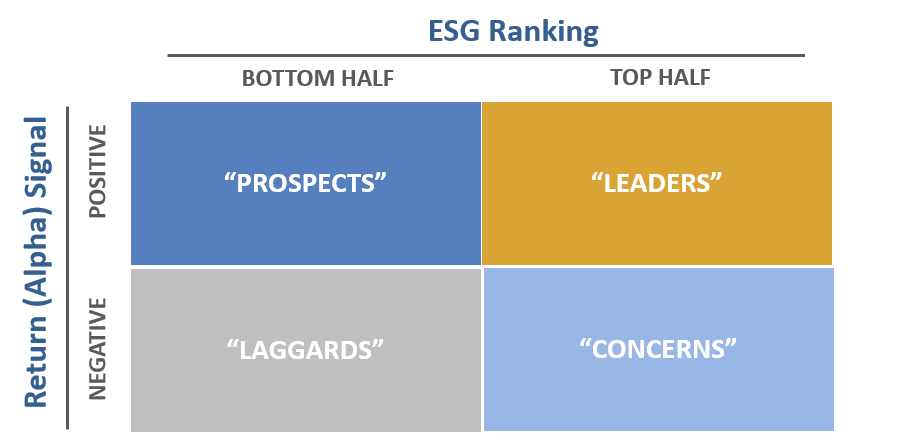

The combination of ESG Rankings and a forward-looking alpha signal creates a matrix that offers a clear basis for helping investors to avoid hidden risks.

- Each stock in the universe/fund/benchmark is in either the top- or bottom 50% in terms of its ESG ranking.

- Each stock has either a positive or negative forward-looking alpha signal (excess return adjusted for market and sector effects).

- Each quadrant is the intersection of stocks in the top/bottom half of ESG rankings that have a positive/negative alpha signal.

The Four Quadrants

Leaders – These stocks are in the top half of their universe based on OWL’s ESG Consensus rankings, and have a positive alpha signal. Active managers with ESG exposure mandates who want to limit ESG-related performance risk begin their analyses in this quadrant.

Prospects – These stocks are in the bottom half based on ESG rankings, but their alpha signals are positive. They may offer interesting opportunities, particularly for fundamental managers.

Concerns – These stocks are in the top half of their universe in terms of ESG consensus rankings so they may pass an ESG “screen”, but their alpha signals are negative. This is a warning sign of risk that calls for further investigation.

Laggards – Stocks in the bottom half of their universe in terms of ESG consensus rankings with negative alpha signals are “sell” or “underweight” candidates for long-only funds, while long/short funds might choose to short these names.

Our Process

Using aggregated ESG data from OWL ESG’s broad-based, multi-sourced, unbiased dataset, we rank companies across a wide range of E, S and G criteria. Then we go much further – we identify key E, S and G characteristics that…

- explain ESG-driven excess returns historically, and

- identify stocks with positive forward-looking ESG-driven alpha signals.

Based on these characteristics or “key performance indicators”, we rank companies (U.S.-only and Global, ex-U.S.) according to these dimensions and build the matrix.

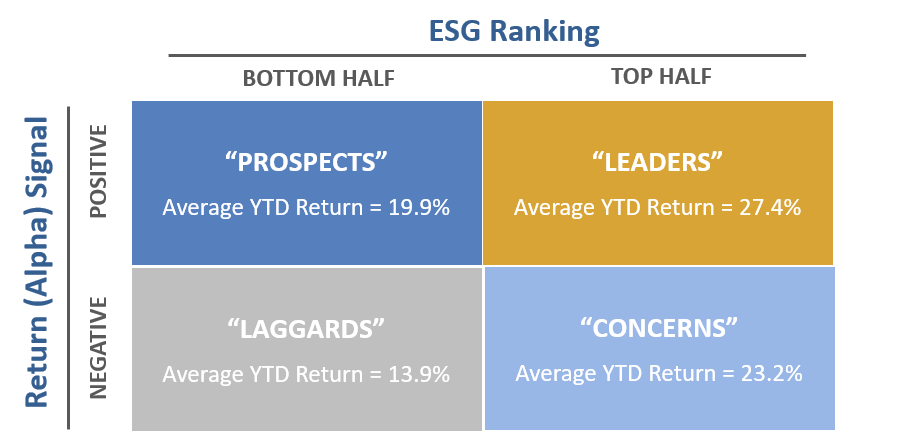

Returns are for 2019, for an International Developed ETF (EAFE Index). The insights that come from combining Rankings and Alpha Signals are compelling: the Leaders quadrant (average return, equally weighted) outperformed all other quadrants and, in this case, delivered almost double the Laggards’ return. Each quadrant represents a “basket” of stocks for asset managers to analyze further.

Outperformance often depends on avoiding mistakes.

Our basic premise: any strategy, whether fundamentals-driven or quantitative, has an ESG component that affects performance. The ability to identify positions with hidden ESG risk leads to better performance – whatever your values.

Asset managers can use Confluence’s alpha signals to add an ESG dimension to proprietary strategies, both fundamental and quantitative. Our alpha signals reduce the risk of investing based on raw ESG scores that are not designed to provide signals about returns. Any fund or benchmark can be analyzed this way.

Most investors cannot identify ESG-related performance risk

The trend is clear. ESG is becoming the third exposure mandate, along with style and risk. Adding our alpha signal to ESG scores or rankings creates a framework for decision-making that provides much more information than one-dimensional rankings. OWL’s Alpha Signals represent a powerful opportunity for those who have the tools and know how to use them.